tax abatement definition for dummies

For example if one receives a tax credit for purchasing a house one receives tax. However for sales and use tax purposes only those purchases made after the abatement is granted will.

Canadian Controlled Private Corp Canadian Tax Lawyer

In essence this program is a reprieve that allows you to escape.

. Tax Increment Financing aka Tax Allocation Districts Tax Increment Reinvestment Zones etc. A reduction in the amount of tax. Essentially it means banking on the increase in property tax revenue that will result when the project is finished.

What Does Tax Abatement Mean. It is offered by. A tax abatement is a reduction in property taxes for a specific period of time.

IRS Definition of IRS Penalty Abatement. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax. Your browser doesnt support HTML5 audio.

The local government adds the abatement to its. Noun C or U TAX FINANCE PROPERTY uk. An amount by which a tax is reduced.

It is most commonly applied to condominium or co-op units but can apply to any type of real. You may wonder just what the one-time Tax Penalty Abatement program entails. Abatement costs are generally.

The word abate means to reduce in value or amount So a tax abatement is simply a lessening of tax. A reduction of taxes for a certain period or in exchange for conducting a certain task. One method is called tax increment financing.

Your browser doesnt support HTML5 audio. Businesses and consumers will take steps such as. Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement.

A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. Abatement as a percentage of tax payable a dollar amount the tax attributable to a portion of the parcels market value or something else. An abatement applies to all real and personal property incorporated into the project.

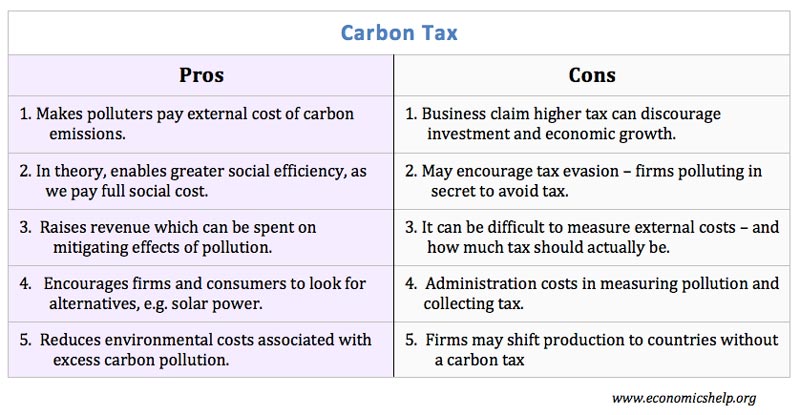

A tax abatement credit is. Under a carbon tax the government sets a price that emitters must pay for each ton of greenhouse gas emissions they emit. Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate behavior in a firm.

TIF allows local governments to invest in infrastructure and other improvements and pay for. Who Receives a Tax Abatement. The savings in that case results from the difference in the taxability or valuation of.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. A cost borne by many businesses for the removal andor reduction of an undesirable item that they have created. Definition of tax abatement.

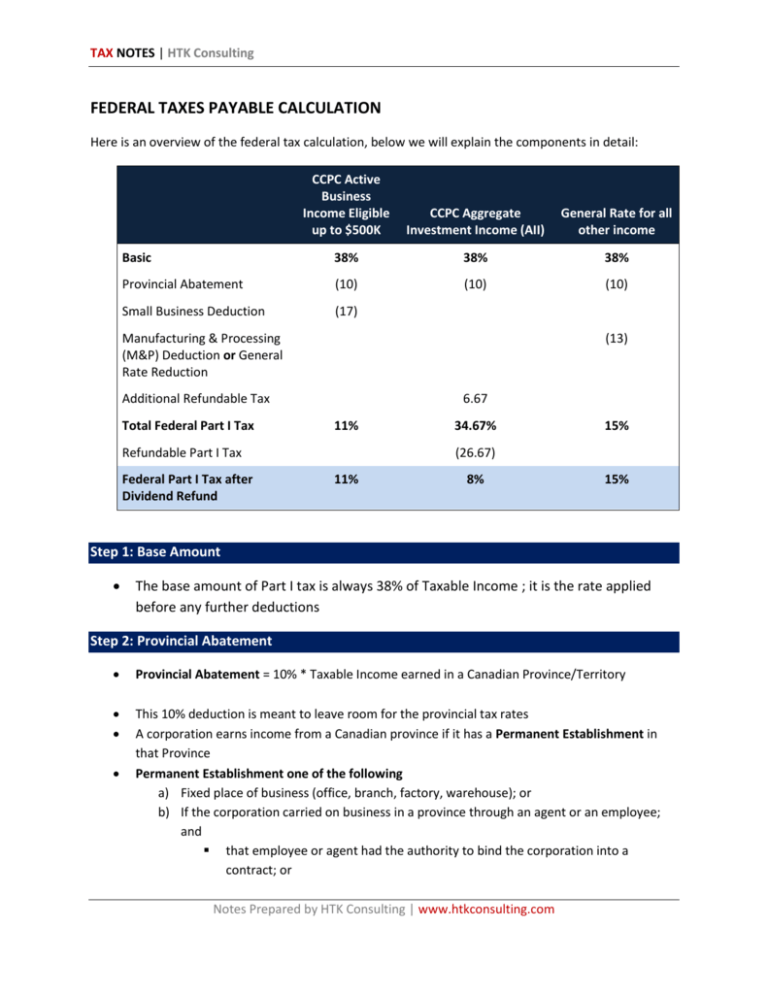

Federal Taxes Payable Calculation Provincial Abatement

Kalfa Law Business Tax Rates In Canada Explained 2020

Kalfa Law Business Tax Rates In Canada Explained 2020

Taxtips Ca Business 2020 Corporate Income Tax Rates

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

Kalfa Law Business Tax Rates In Canada Explained 2020

Tds Tcs General Information Due Date To Deposit Tds And Tcs Issuance Of Tds Certificate Accounting Taxation Income Tax Return Due Date Accounting

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

What Is Definition Of Refundable Quebec Abatement Cubetoronto Com

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

Definition What Is A Tax Return Tax Return Tax Preparation Tax Preparation Services

Carbon Tax Pros And Cons Economics Help

Kalfa Law Business Tax Rates In Canada Explained 2020

Corporate Income Taxes In Canada Revenue Rates And Rationale Hillnotes

Modeling Property Tax Abatements In Real Estate Youtube

Vertex Form Reflection Over X Axis 2 Things You Didn T Know About Vertex Form Reflection Ove Quadratics Reflection Vertex

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)